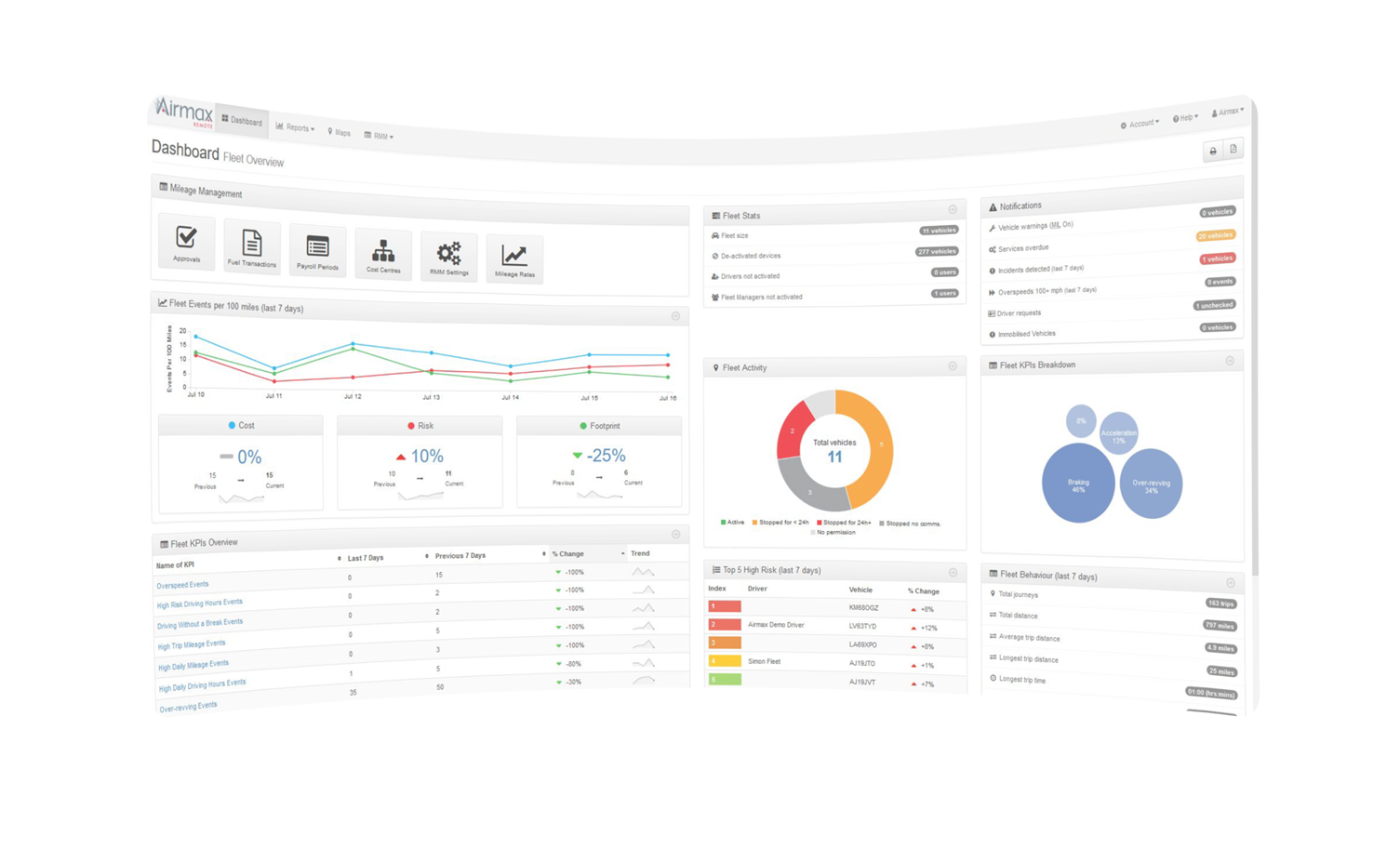

Gain actionable insights into

your fleet performance

Our unique sector solutions

Emergency Services

Empower your emergency service with mission critical, second-by-second data

Corporate Fleets

Getting the right telematics data to the right person at the right time

Leasing

Unlocking value and boosting performance with fleet telematics

Driving excellence through innovative connected car technology

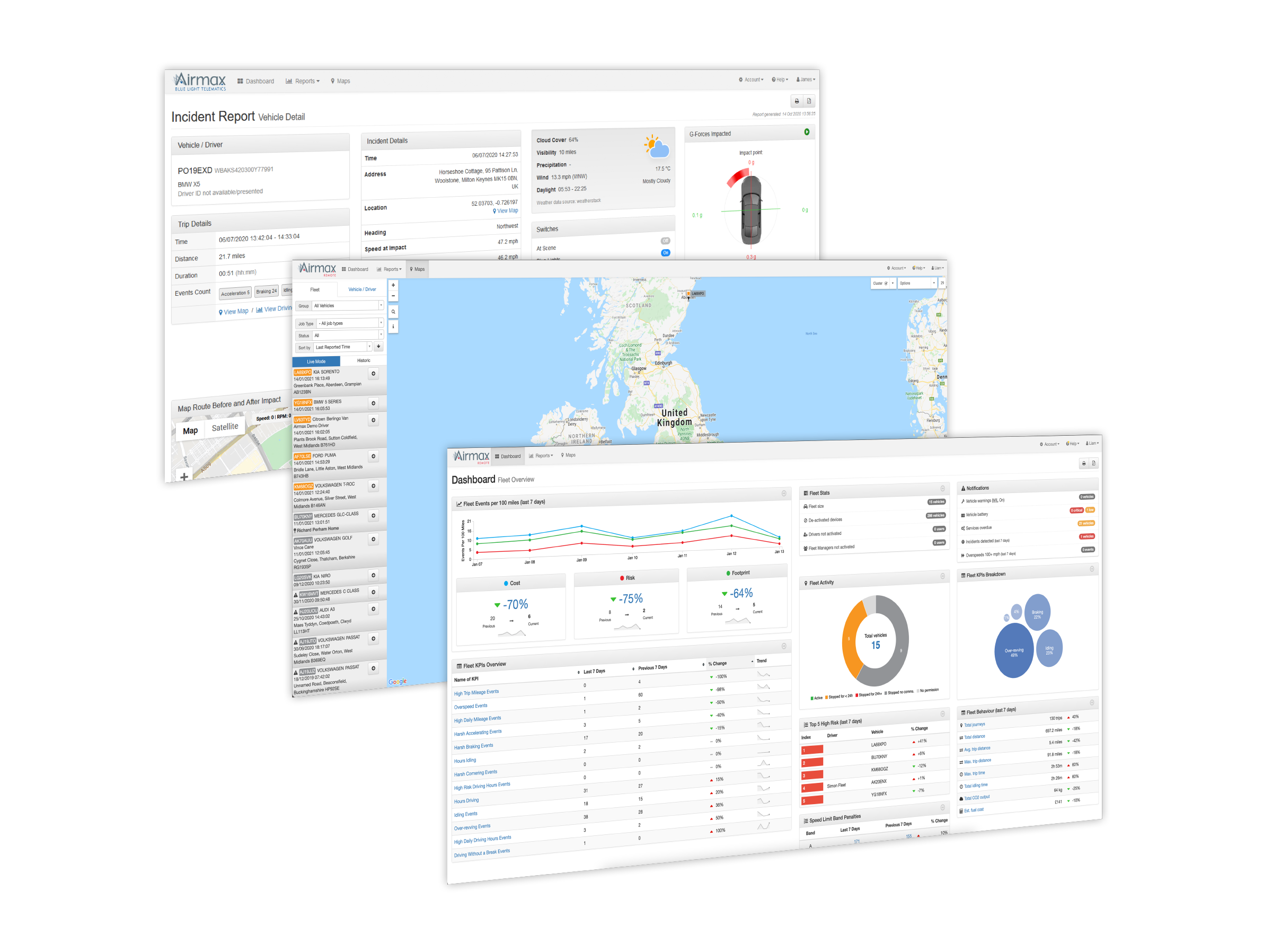

Airmax Remote specialises in advanced fleet telematic solutions that delivers actionable business intelligence and operational insight. With unique driver behaviour, remote vehicle diagnostics and mileage capture functionality, our technology is proven to transform fleet performance and support informed decision-making. Since 2002 we have deployed over 100,000 in-vehicle devices, working with 10% of the UK’s blue light fleets and 12% of the top FN50 fleets.

A trusted supplier

Our expertise is built on years of experience and our commitment to the industry. As a trusted provider we have achieved the following certifications and accreditations.

Our aim is to deliver solutions that possess the highest levels of data accuracy and analysis possible, using telemetry and proprietary technology to:

Capture real-time data

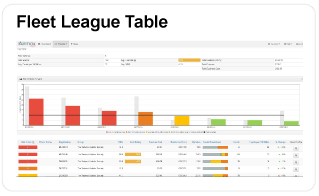

Optimise fleet efficiency and calculate accurate running costs

Achieve Understanding

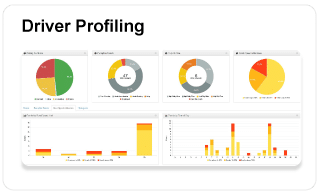

Gain deep and specific insight from all aspects of fleet activity

Reduce vehicle downtime

Proactive monitoring of vehicle health and specific attributes

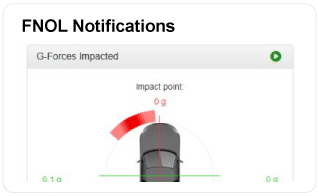

Record all incident details

Reduce vehicle VOR and downtime as well as capture accurate FNOL data

Enhance duty of care

Improve safety engagement and compliance through driver risk management

Build the business case

Demonstrate return on investment and total cost of ownership

Proven ways we are helping fleets

8% savings from driving

style improvements

Increase capacity

utilisation by up to 16%

34% reduction in road

collisions

Airmax in numbers

1,500 MILES

Saved per year, per vehicle because of

better planning

£11 MILLION+

Vehicles safely recovered after

being stolen

21% SAVINGS

Reported in real world MPG

Become a partner

Looking for a technology partner who can integrate and deliver a white-labeled telematics solution providing

award-winning services and best-in-class vehicle data?

Find out more about the savings potential of our advanced fleet telematics

News and industry insight

Celebrating a decade of excellence: Airmax Remote renews ISO 9001:2015 accreditation

We are delighted to announce that Airmax Remote has successfully renewed our ISO 9001:2015 accreditation for the supply of advanced telematics and vehicle diagnostic systems within the UK. This year marks a significant milestone as we celebrate 10 years of continuous certification under this internationally recognised standard, underscoring our solemn commitment to diligence, regulatory conformance, quality and excellence.

Airmax Remote becomes signatory to The Police Industry Charter

This March, AirMax Remote proudly became one of the founder signatories to The Police Industry Charter, a landmark initiative spearheaded by BlueLight Commercial alongside key stakeholders such as the NPCC, APCC, RISC, the Home Office and the Office of the Police Chief Scientific Adviser.

Airmax Remote Ltd to showcase its advanced fleet telematics solutions at the 49th NAPFM event

Airmax Remote Ltd, a leading provider of advanced fleet telematics solutions for the emergency services and critical fleets, is delighted to announce that it will be exhibiting at the 49th NAPFM event on 4th and 5 July 2023 at Telford International Centre.The NAPFM...